30.10.2025

Geopolitical balancing act

At a time when there is a lot of talk about artificial intelligence being a bubble that is ready to burst, there are those Gulf states who want to become major players. Yassamine Mather investigates

Signs that we may be in an AI bubble are increasingly visible: major technology companies are pouring vast sums into computing infrastructure, AI startups are receiving sky-high valuations, despite lacking clear paths to profitability, and there is a widening gap between small-scale experiments and large-scale systems that genuinely deliver productivity gains.

If these expected results fail to appear on the scale investors anticipate, the market is likely to undergo a correction - marked by falling valuations, company mergers and a decline in speculative excitement. Such an adjustment would not mean that AI lacks real economic or social value, but that its growth would settle into a slower, more sustainable pattern, dominated by a few powerful players rather than many smaller innovators.

It is against this backdrop of speculative enthusiasm and potential correction that we should assess recent US initiatives to promote large-scale AI cities in Saudi Arabia and other Gulf states, including the United Arab Emirates. These projects are being framed as evidence of an impending AI-driven transformation of the region, yet they may also reflect the same speculative optimism fuelling the global AI boom.

Political debates

Indeed, the exaggerated projections of success surrounding these ventures are influencing political debates beyond the Gulf. In Iran, reformist factions within the Islamic Republic have seized upon these developments to argue for closer ties with Washington, warning that Iran risks being left behind, while its Arab neighbours reap the benefits of US-backed AI projects. Before evaluating the validity of such arguments, it is worth looking more closely at the nature of these proposed deals.

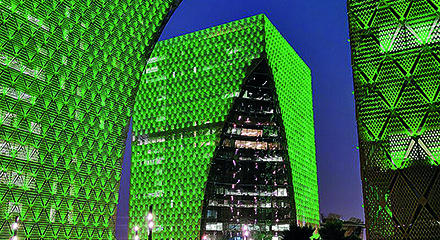

United Arab Emirates: During Trump’s May 2025 Middle East tour, the US and UAE announced a major agreement to build a huge AI campus in Abu Dhabi - often described as the “largest outside the US”. The campus would cover about 10 square miles and aim for a power capacity of five gigawatts (GW) of data-centre operations.1

The deal also involves the US changing export-control policy, so that the UAE (and other Arab states in the Persian Gulf) can import advanced US AI chips (which previously were restricted) to power those data centres. There is a broader deal, in the form of an investment framework of about $1.4 trillion over 10 years (including AI, semiconductors, manufacturing) and then an extra $200 billion announced in the context of AI/tech deals.

Saudi Arabia: its AI ambitions are being channelled primarily through its public investment fund (PIF) - one of the world’s largest sovereign wealth funds. This creation of Humain (or Humain.ai) serves as the kingdom’s central vehicle for developing AI infrastructure, including data centres and large language models tailored for the Arabic-speaking world, according to Forbes.

A landmark deal with Nvidia, announced in May 2025, involved the supply of “tens of thousands” of advanced AI graphics processing units to fuel these projects.2

In theory the partnership is crucial for bypassing one of the biggest bottlenecks in AI development: access to cutting-edge hardware. However, there are doubts on how this has and will progress in practice, as the average Saudi AI developer or startup still faces significant challenges in accessing the latest hardware. US Export Controls remains a major wildcard and a threat.

Qatar: it is also firmly part of the Gulf’s AI rush, but its approach, as reflected in public announcements, appears slightly differently structured. The country has declared its intention to invest a colossal $1.2 trillion into its tech, AI, quantum computing and aviation sectors - a figure that dwarfs many other national initiatives and highlights the region’s competitive spirit.3

There are differences here in that, unlike the UAE and Saudi Arabia, Qatar has not yet publicly detailed any ‘mega AI campus’ of a specific size and power capacity. Its strategy may be more distributed across sectors or simply less publicised at this stage, but the financial commitment confirms its serious intent to be a major player.

No doubt all these projects are strategically critical for both the Arab states and their international partners.

Dependency

For the Persian Gulf states this represents a definitive move away from hydrocarbon. The combination of massive sovereign capital, a favourable climate for solar power to maintain energy-intensive data centres, and state-controlled economies allows for rapid, large-scale infrastructure build-out that is difficult to replicate in less autocratic countries.

For the United States, deepening technology ties with the Gulf states serves a key geopolitical objective: anchoring these wealthy and influential states within the US technological orbit and stopping further rapprochement with China and the Brics countries. By granting chip export licences and fostering partnerships with companies like Nvidia and Microsoft, the US aims to create a strategic buffer against China’s expanding global tech influence. It is also a calculated, strategic move to ensure that the foundational infrastructure of the next digital era is built according to western, not Chinese, technology and standards.4

While the financial resources make these projects plausible, their ultimate success is by no means certain. Sovereign wealth funds such as Saudi Arabia’s PIF, Abu Dhabi’s Mubadala, and Qatar’s Investment Authority (QIA) give Gulf states access to enormous reserves of capital. These funds, built from years of oil and gas revenues, allow them to pour billions into infrastructure, technology and global investments without the fiscal limits or political scrutiny that most governments face. Unlike western countries that must deal with budget deficits, debt ceilings or short-term electoral pressures, these states can act quickly and decisively, using their wealth to shape regional development and secure influence. However, these flashy AI projects are simply used to boost national prestige or win political points instead of focusing on real innovation and long-term research. The AI showcases look impressive, but do not deliver much lasting progress.

When so much money is controlled by the dictatorial state, AI becomes a tool of government power - used for surveillance and control instead of the public good. And, because these funds can lure foreign tech companies with generous deals, local industries might end up depending on outside talent and technology instead of developing their own. Here we already have the talent gap: probably one of the most significant bottlenecks. Building and operating a world-class AI ecosystem requires a deep pool of AI researchers, data scientists and hardware engineers. The Gulf states will need to aggressively attract global talent and rapidly upskill their local populations - a long-term endeavour.

While cheap land and abundant sunshine make these countries attractive locations for data centres, the climate also brings challenges. Extreme heat means cooling systems must run constantly, using huge amounts of water and energy - often cancelling out some of the benefits of solar power. Dust storms and humidity will also damage sensitive equipment.

In addition, relying heavily on solar energy requires massive upfront investment in infrastructure and battery storage to keep operations stable when the sun is not shining. Finally, the region’s dependence on desalinated water for cooling adds environmental pressure, since desalination is energy-intensive and results in massive carbon emissions.

A 5GW campus is an enormous thermodynamic challenge - especially in a desert environment, where summer temperatures are around 40oC. The energy required for computing and, more critically, for cooling the chips, will present serious challenges. Ensuring a stable, sustainable and cost-effective power and water supply for cooling is a very difficult engineering task, even in more moderate climates.

Self-reliance

AI is evolving at an extremely fast pace. A data centre designed for today’s largest ‘large language models’ will be inefficient or obsolete for the AI models of 2030. This creates a massive risk of capital investment being stranded.

Then there is the geopolitical balancing act: the US remains wary of its advanced technology being transferred to China through Gulf partners who maintain economic ties with Beijing. This requires the Gulf states to perform a delicate balancing act, and any misstep could result in the revocation of critical technology export licences.

The reformist, pro-west factions of the Iranian regime are mistaken if they believe that a resolution of the nuclear issue will pave the way for a similar agreement with the US. Despite ‘promises’ by negotiators in the Trump administration, the extensive framework of US sanctions beyond the nuclear issue would severely limit the transfer of critical AI technology and hardware.

In addition, for Iran, investing billions in a physical AI city, while facing significant economic challenges, including sanctions, inflation and infrastructure needs, would be a serious misallocation of scarce national resources.

As Vali Nasr, professor at Johns Hopkins University, points out, when it comes to technology, international sanctions have forced Iran to become self-reliant, sparking innovation in its domestic tech industry. Examples include:

- Aparat: Iran’s version of YouTube;

- Digikala: a successful e-commerce platform, often called the ‘Iranian Amazon’;

- Snapp: the dominant ride-hailing and delivery service, similar to Uber.

However, these platforms operate within a tightly controlled digital environment - shaped by state surveillance, censorship and content filtering. Despite these restrictions, Iran’s relative technological base means it could, in principle, be better positioned than many of its neighbours to pursue developments in AI and related technologies - particularly as it continues partnerships with China to navigate around sanctions.

-

www.forbes.com/sites/saradorn/2025/05/15/us-will-build-massive-ai-data-center-in-abu-dhabi-see-the-list-of-deals-trump-announced-in-the-middle-east.↩︎

-

www.channelnewsasia.com/business/us-tech-firms-nvidia-amd-secure-ai-deals-trump-tours-gulf-states-5127141.↩︎

-

www.invest.qa/en/media-centre/news-and-articles/invest-qatar-partners-with-quantinuum-to-accelerate-expansion-and-advance-the-regions-quantum.↩︎

-

www.rand.org/pubs/research_reports/RRA1859-1.html?utm_source=chatgpt.com.↩︎