03.02.2022

Fuelling the cauldron

Esen Uslu reports on the short-termist cuts in interest rates and the resulting inflation and political turmoil

The reckless economic policies of Recep Tayyip Erdoğan’s presidential government have brought havoc to the working people of Turkey. Erdoğan’s now infamous phrase, “the interest rate is the cause, the inflation rate is the result” has defined his economic policy.

With the Turkish lira sliding against the principal foreign currencies, and inflation rising, the central bank was forced to cut interest rates. The outcome was an uncontrollable downward spiral. Erdoğan’s economic policy could only be implemented by economic charlatans, and several finance ministers and directors of the central bank have been brought in and discarded, only to be replaced with new ones in short order. Changing the top personnel as if they were temps has not stopped the rot.

The current central bank director has reduced the interest rate from 19% to 14% in the four months starting from September 2021. The price of the US dollar skyrocketed from 9 to 18 liras, and 70% of total bank deposits in Turkey were converted into foreign currency deposits as panicking people tried to protect their savings.

Skimming

A face-saving way was found - a method of pretending to keep interest rates low, as promised by Erdoğan, while attempting to stop the slide of the lira and dollarisation of the economy. In late December the government invented a new savings instrument: “Foreign exchange rate protected Turkish lira termed deposit account” - which is a mouthful of words to veil raising the interest rate on Turkish lira deposits.

To keep this policy working, and to keep the dollar below 14 liras, the state had to sell foreign currency from its reserves. However, that was done through back doors: while pretending that the central bank had not sold foreign currency, the state banks continued to sell in a backhanded way. To veil the whole operation, the customary reporting of central bank reserves and other financial data was suppressed. As Reuters reported six weeks ago:

The Turkish central bank’s reserves remain depleted after a series of interventions in 2019-2020 in which some $128 billion was sold via state banks.1

The policy seems to be holding at present, as the price of the dollar is only creeping upwards slowly during January. Erdoğan is boastful, declaring that they “stopped the boiling and skimmed the foam off the situation”. The central bank’s diminishing reserves were band-aided with swap agreements with the Gulf states, but these barely hide the reality: an additional $20 billion dollars was sold in December alone.

The financial ambush, or bull-trap, was set on December 20. The price of the dollar was allowed to rise until the insider traders started selling high. When the dollar price had fallen, they bought back, making enormous profits in a couple of days, while thousands of small savers - who had tried to protect their money by buying foreign currency - lost out. This policy would be ruinous if maintained in the long-term, so it may be a part of Erdoğan’s preparations for a snap election later this year.

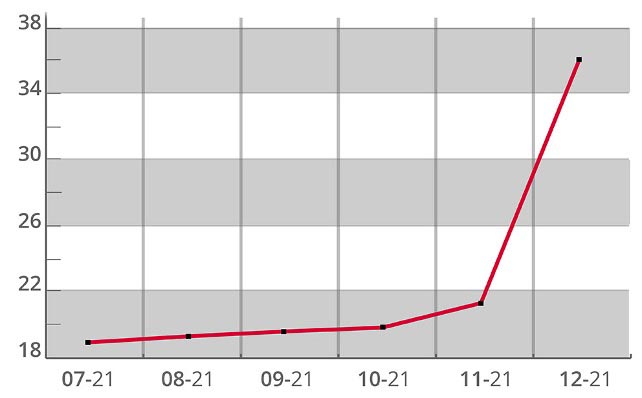

Figure 1 - Consumer Price Index (2003=100) year to year % changes - Turkish Statistical Institute

Rampant

According to TurkStat - the Turkish Statistical Institute - the consumer price index (CPI) has risen rapidly. TurkStat is so corrupt that only the government quotes its indices, and nobody believes any of them. Its loyal director was sacked recently after he and the institution lost the last bit of credibility. However, even according to their doctored figures, the CPI rose by 36% in December.

That figure hides the real inflation facing ordinary working people in their day-to-day life. Transport prices soared to 79%, the food and drinks basket jumped 44% and rent increases are also exorbitant.

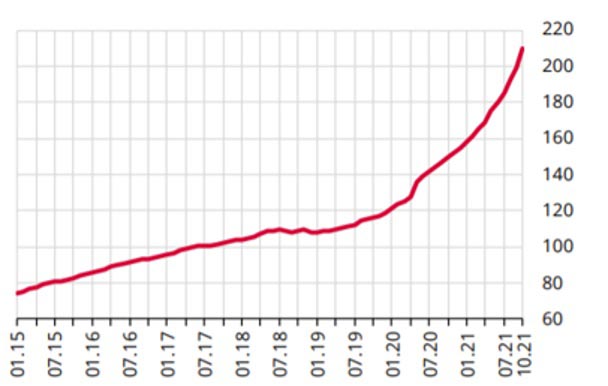

Figure 2 - House Price Index, Central Bank of Turkey

Faced with this, the government was forced to raise the compulsory monthly minimum wage 50% to the equivalent of $275. A 30% hike was applied to civil servant’s salaries and a pensions rise to the equivalent of $190. However, these rises have already been eaten away by inflation. The January figure, to be announced in February, is expected to reach new heights. According to Reuters (January 28):

The median estimate of 17 economists in the Reuters poll for annual inflation in January stood at 46.68%, the highest since April 2002, with forecasts ranging between 40% and 52.19%.2

Erdoğan conceded, in a recent speech, that “Turkey will carry the burden of inflation for some time”, and added that Turkish exports are becoming more competitive and expected to increase. However, the manufacturing industry is facing challenges, as energy prices soar and gas supplies from Iran stopped in the middle of a harsh winter, leading to power cuts to industry and factory closures for weeks.

Construction

When bank deposits cannot provide positive interest rates to protect savings, people tend to switch to buying gold or foreign currency, but this is being made harder by the government. The only remaining viable option is to buy real estate. The government has always tied its hopes of economic growth and increased employment to a growing construction industry.

That is one of the reasons Erdoğan attempts to keep interest rates low - so that buying a house on credit remains a viable option. Consequently, despite soaring inflation, demand for houses remains high and has kept the prices rising.

This is how Erdoğan inflates the property balloon which will eventually pop, preferably at an opportune time - after the elections. Mortgage sales have rocketed 209%.

An extension of this policy is the citizenship-for-homes policy. Erdoğan has offered citizenship to foreigners who buy real estate worth at least $250,000, and those who do not sell the property for three years will get a Turkish passport. House sales to foreigners surged 77%.

The housing stock built before the 1999 earthquake in the Istanbul region is crumbling. The urban regeneration programme, funded by easy credits, has doubled. Tearing down untenable properties and rebuilding them, as well as structurally strengthening viable properties, are also methods being used to give a new impetus to housing construction.

Tourists

As the pandemic is - allegedly - abating, tourists have started returning to Turkey, and tourism revenues have begun to rise again. Last year the tourism revenue climbed by 103% to $24.5 billion and helped reduce the trade deficit. However, it is still a long way short of the 2019 pre-pandemic level of $34.5 billion.

It seems that Turkey’s foreign policy blunders and its foray deep into Iraqi and Syrian territories does not affect the tourism industry. Health tourism to Turkey, especially for hair transplanting - Istanbul airport is dubbed the “h-airport” - and cosmetic surgery at cheap rates, boomed to $5.8 billion a year. While the Turkish lira fell 44% in a year, the boost provided by the tourism industry is very important for Erdoğan’s government.

Fightback

The unorthodox monetary policies and meddling with policy-making has turned the economy upside down. Palliative measures are no longer sufficient to keep the working class in check. The minimum wage rise coincided with a collective agreement in the metal manufacturing sector.

The yellow unions once again declined to take any meaningful industrial action to defend wages and conditions, but wildcat strikes and occupations have flared up. It is hard to say at present if the wave will continue or settle down, but the omens are that the working class is stirring.

Religious, nationalist and misogynist prejudices are still rampant - the perennial problem of the Turkish left, hampering the bringing together of Kurdish opposition to the regime with working-class action as well as other social movements, such as the equal citizenship demands of the Alevi population, and women’s struggles.

The possibility of an early election provides an opportunity to work together, albeit in a limited scope, but recent developments within the left movements show dark clouds forming that may bring a damping down of expectations.

However, under the direct control of Erdoğan, the government’s fiscal policies continue to stoke the fire under the boiling economic cauldron. Like the sorcerer’s apprentice, he is unable to stop or switch back. That would be political suicide. He will press forward at any cost. He will be very happy if he is allowed to skim off the froth.

As the bard famously said: “Double, double toil and trouble; Fire burn, and cauldron bubble”. As Erdoğan carries more firewood to the cauldron, we must expect many cataclysms in the coming months. Our hope is that the “Liver of blaspheming Jew; Nose of Turk, and Tartar’s lips” will be spared from the cauldron.

-

Reuters, December 23 2021: www.reuters.com/markets/europe/turkey-seeks-relief-with-fx-swap-deal-by-year-end-sources-2021-12-23.↩︎

-

Reuters, January 28 2022: www.reuters.com/markets/asia/turkish-inflation-seen-soaring-20-yr-high-nearly-47-january-2022-01-28.↩︎